A new horse barn or kennel purchase represents a significant financial investment for most folks and funding it can be worrisome. Any time a capital outlay is required, taking that step is something that demands a firm plan of action.

Leveraging the credit score, hard asset value, or depleting a 401K or savings account balance are all on the table. But there are many more options available for consideration to garner the right funding for almost any individual situation. All of which offer pros and cons that it is wise to be cognizant of before taking up the pen and signing on the dotted line or digitally sign, as it is more likely to be these days.

The advent of online access to financial markets has opened up a world of opportunities for funding projects large and small. For some folks, a simple installment loan may suffice to help defray the initial costs of a project, while for others that are establishing a business model a different approach may be beneficial for tax reasons.

Banking On Financial Help

If your planned new structure has a high price tag, then it is highly likely that you’ll be relying on some major help to finance the project. If this is the case, sourcing the best option for financial aid will require diligent research. A slightly higher interest rate from one option over another can mean additional spend over the life of the loan, and early pay off penalties, balloon payments, points, loan initiation fees and the like can all trip up an inexperienced borrower.

Taking out any loan that is secured by assets such as your home or other hard ‘real’ assets you may own such as commercial buildings or business facilities can be obtained as loans with variable interest rates or fixed interest rates, suspended rate periods, or credit lines that can be drawn on to any degree needed through time.

First, second or even third mortgages on existing properties that are owned are all options. But before you step into that corridor it is wise to consult with a licensed financial consultant if you are in any doubt as to the best way forward. Tax advice on depreciation and amortization, deductibility of points and interest, and a myriad of other factors that reduce the overall spend on the new building over time, are all worthy of investigation.

Unsecured loans will likely require the lending institution to verify your credit worthiness, and be reviewed in terms of your cash at hand, investment portfolio value including pensions or 401K, monthly expenses including rent/home, vehicle or other loan expenses, etc.

Obviously the larger the down payment/deposit you can put on a purchase, the better chance you have of securing funding, and theoretically the better rate and deal you’ll be able to negotiate for the term of the loan.

Where Best to Resource Financing Opportunities

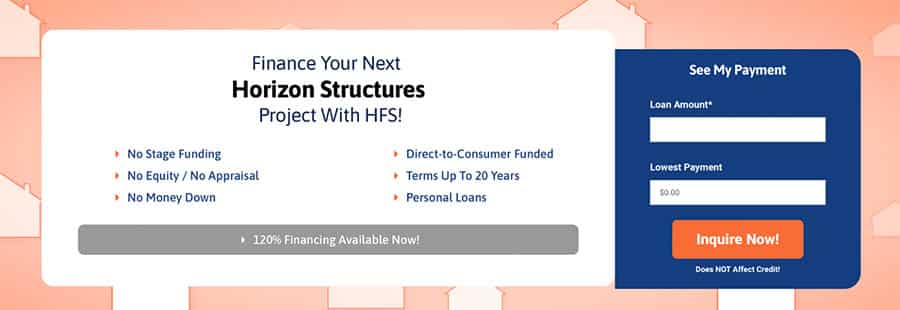

While the open credit market and your local bank is always a good place to look for credit options, many horse barn and kennel manufacturers will offer financing products through third parties as a means to help their clients achieve their goal of owning the building. This provides a good link for the prospective buyer, as a lot of the ‘legwork’ has already been done on the loan by the manufacturing company.

Leading construction companies within the horse and pet industry will likely have good access to better deals than smaller entities or individuals and have the wherewithal to absorb some of the risk for smaller financial programs such as rent-to-own options.

Check the terms and conditions of purchase carefully wherever and however you buy. A company that stands behind its products, offers clear and concise language and has a proven good reputation is a great resource for both the structure itself and the loan options with third parties that they will likely have put together to push their products to market.

Always check ALL the small print in any loan contract or loan application document or online application for any hidden fees, future exorbitant penalties or interest rates, cancellation fees, etc. and look for a clearly written, non-ambiguous language in all financial documents. If there is something you don’t understand, don’t ignore it. Find out exactly what you are signing up for and know your rights as a consumer.

How Much You Need to Borrow Affects Choice of Financing Options

Options for financing are linked to the amount you need to borrow. Thus your choice of places and methods to borrow money will likely be attached to the amount of the loan.

Shopping by credit amount required is a good place to start. Breaking it down to its lowest level, would be purchasing a run-in shed, shedrow barn or low-profile barn or smaller residential or commercial kennel, as then the lesser spend may fall under the option to even rent to own it.

The nature of the structure will need to offer mobility option for this to work, as the rent-to=own period once completed over a few years would require removal of the unit if the loan were defaulted upon at any point in time before full payment was completed.

Thus, prefabricated and modular building companies will likely offer this rent-to-own opportunity. And if there are no prepayment penalties (which in most States are not allowed by consumer laws), and the timeline and payment amount works for the borrower, this can be a feasible method to finance a smaller structure. Often no credit checks are even made for this option.

The availability of renting to own a structure will be dependent on the manufacturer of the product. The larger and more established the place you source your new barn or kennel from, the more likely it is that a rent-to-own offer will be on the table.

Generally, a spend of between $5000 and $25,000 may fall under this category, though the location for delivery and set up may be limited to a certain distance from the manufacturing point to minimize freight costs should a return be necessary. Availability of this option may also be governed by State laws, or by a manufacturer not wishing to engage in this activity in certain States.

Loans for smaller amounts such as $5000 up to much larger amounts ($100,000 is not uncommon), may also be obtained with a credit check and as a straight loan either with zero interest for a period of time or with a fixed or variable rate of interest.

Be aware that zero interest loans that have an end date for free of interest feature to expire, may hit you hard with a high interest percentage if you don’t fulfil your obligation within that time period. So, this type of loan likely only offers temporary help for an initial period and works well only if you have the financial wherewithal to keep to the short-term commitment.

Personal and unsecured loans can obviously extend up to much higher amounts as home improvement or home equity lines of credit.

Borrowing may be available up to 120% of the purchase price of the barn or kennel, which is helpful to cover additional expenses of the build that may apply. In the case of larger structures that might include covering site preparation costs, adding electric or other service access to the building, freight and delivery charges etc.

Securing larger financing amounts of money may require a co-applicant, and obviously any jointly owned home would require both parties to sign on the loan as responsible for any home equity line of credit.

A Word About GSA (Government Services Administration)

Fast approval for purchase of a single or multiple kennels, horse barns or other structures is available to government entities through the GSA program where the building producer is federally certified to participate in the program.

GSA can be complex to navigate, and it is wise to opt to work with a company that has proven experience in the field and has trained staff well-versed in the application and fulfillment process.

Modular building companies are a great way to go for GSA needs as the structures can be customized to task and requirements, delivered quickly and be ready for almost immediate use also avoiding costly delays and annoyances on site. Another advantage to working with a modular building company is their fast production option for large purchases.

The modular construction company as a choice for supplier for GSA needs offers a boon for government agencies that require flexibility in not just the design and individual specifications of a kennel or horse barn, but also mobility of a unit(s) at a future juncture to address relocation requirements due to expansion or change in operations, fluctuation in regional needs, or closure of a specific site.

Modular buildings’ self-contained design also makes them particularly valuable as they offer good security. This is particularly useful where K9s or service dogs, including Military Working Dogs, or police horses are being housed.